Real Estate Business Qbi . So, their deduction is equal to 20% of domestic. roughly 97% of your clients have taxable income under the threshold. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. 199a final regulations have been released to answer some of the lingering questions on whether rental real. the irs released final guidance to help taxpayers figure out when rental real estate activities might qualify as a “trade or. to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business or rental property, continue reading below.

from www.slideteam.net

the irs released final guidance to help taxpayers figure out when rental real estate activities might qualify as a “trade or. 199a final regulations have been released to answer some of the lingering questions on whether rental real. So, their deduction is equal to 20% of domestic. to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business or rental property, continue reading below. roughly 97% of your clients have taxable income under the threshold. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and.

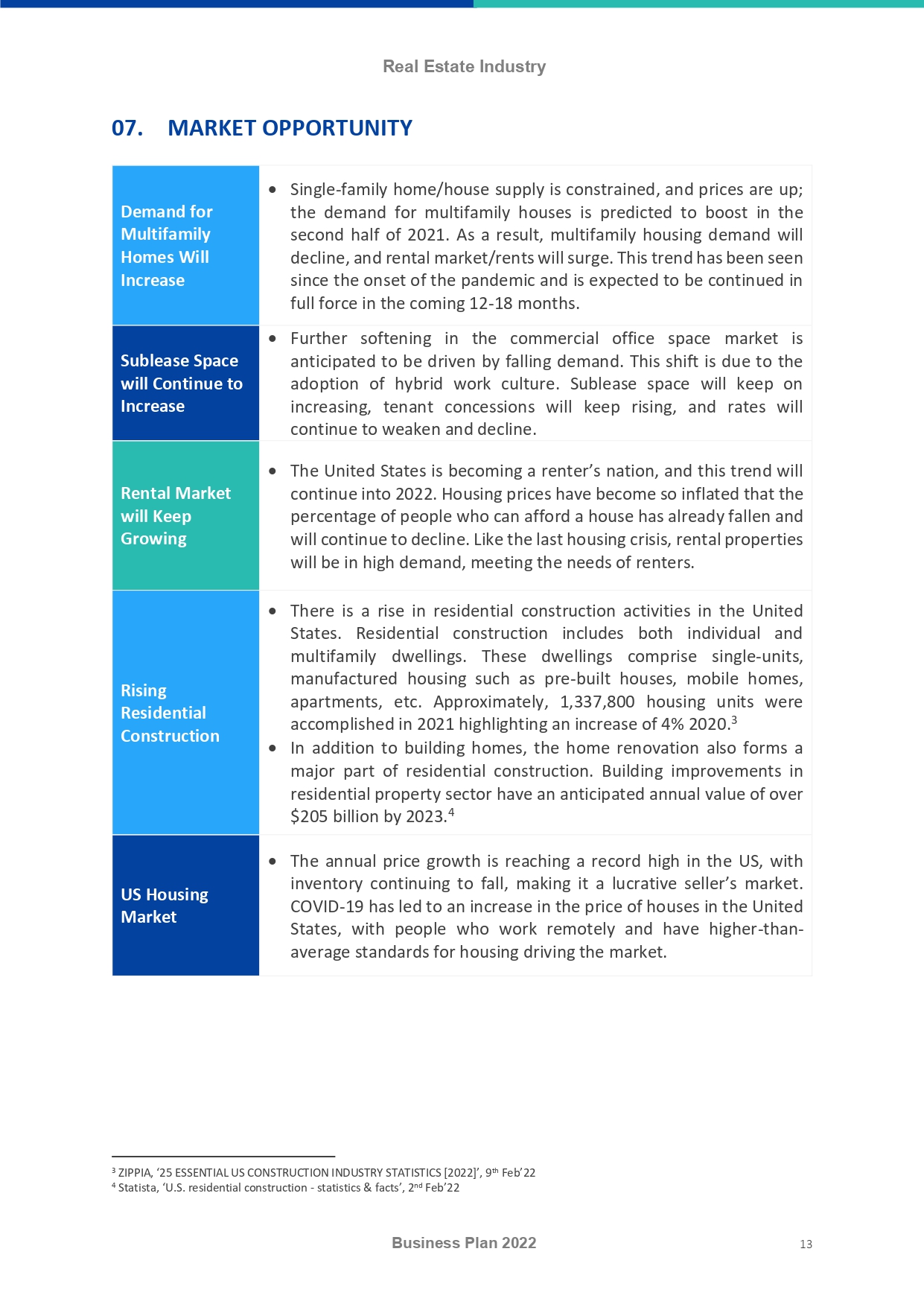

Comprehensive Real Estate Industry Business Plan with PDF Document

Real Estate Business Qbi the irs released final guidance to help taxpayers figure out when rental real estate activities might qualify as a “trade or. to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business or rental property, continue reading below. 199a final regulations have been released to answer some of the lingering questions on whether rental real. roughly 97% of your clients have taxable income under the threshold. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. So, their deduction is equal to 20% of domestic. the irs released final guidance to help taxpayers figure out when rental real estate activities might qualify as a “trade or.

From rcmycpa.com

The QBI Deduction What Real Estate Businesses Need to Know Rosenberg Real Estate Business Qbi 199a final regulations have been released to answer some of the lingering questions on whether rental real. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. roughly 97% of your clients have taxable income under the threshold. the irs released. Real Estate Business Qbi.

From www.vecteezy.com

QBI logo, QBI letter, QBI letter logo design, QBI Initials logo, QBI Real Estate Business Qbi the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. So, their deduction is equal to 20% of domestic. the irs released final guidance to help taxpayers figure out when rental real estate activities might qualify as a “trade or. roughly. Real Estate Business Qbi.

From www.adkf.com

Real Estate & QBI ADKF Real Estate Business Qbi 199a final regulations have been released to answer some of the lingering questions on whether rental real. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. to learn more about the qualified business income (qbi) deduction, and discover what it means. Real Estate Business Qbi.

From www.slideserve.com

PPT What is Real Estate Business? PowerPoint Presentation, free Real Estate Business Qbi So, their deduction is equal to 20% of domestic. 199a final regulations have been released to answer some of the lingering questions on whether rental real. to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business or rental property, continue reading below. the deduction allows eligible taxpayers to. Real Estate Business Qbi.

From windes.com

IRS Finalizes Qualified Business (QBI) Safe Harbor for Rental Real Estate Business Qbi 199a final regulations have been released to answer some of the lingering questions on whether rental real. So, their deduction is equal to 20% of domestic. the irs released final guidance to help taxpayers figure out when rental real estate activities might qualify as a “trade or. roughly 97% of your clients have taxable income under the threshold.. Real Estate Business Qbi.

From amynorthardcpa.com

How to Make Your Rental Property Qualify for the QBI Deduction Real Estate Business Qbi So, their deduction is equal to 20% of domestic. 199a final regulations have been released to answer some of the lingering questions on whether rental real. roughly 97% of your clients have taxable income under the threshold. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate. Real Estate Business Qbi.

From www.eisneramper.com

IRC Sec. 199A Trade or Business IRC Sec. 162 Real Estate Safe Harbor Real Estate Business Qbi 199a final regulations have been released to answer some of the lingering questions on whether rental real. to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business or rental property, continue reading below. roughly 97% of your clients have taxable income under the threshold. So, their deduction is. Real Estate Business Qbi.

From www.slideshare.net

Rental real estate_qbi_safe_harbor_2021 Real Estate Business Qbi to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business or rental property, continue reading below. roughly 97% of your clients have taxable income under the threshold. 199a final regulations have been released to answer some of the lingering questions on whether rental real. So, their deduction is. Real Estate Business Qbi.

From anderscpa.com

Does Your Rental Real Estate Qualify for the 20 QBI Deduction Real Estate Business Qbi roughly 97% of your clients have taxable income under the threshold. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business. Real Estate Business Qbi.

From www.taxuni.com

Qualified Business Deduction QBI Calculator 2024 2025 Real Estate Business Qbi 199a final regulations have been released to answer some of the lingering questions on whether rental real. roughly 97% of your clients have taxable income under the threshold. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. So, their deduction is. Real Estate Business Qbi.

From www.build-review.com

How to Make a Meaningful Career in the Real Estate Business BUILD Real Estate Business Qbi roughly 97% of your clients have taxable income under the threshold. the irs released final guidance to help taxpayers figure out when rental real estate activities might qualify as a “trade or. So, their deduction is equal to 20% of domestic. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20. Real Estate Business Qbi.

From swrmissouricpa.com

IRS Allows Rental Real Estate To Be QBI Deduction Missouri CPA Real Estate Business Qbi to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business or rental property, continue reading below. So, their deduction is equal to 20% of domestic. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust. Real Estate Business Qbi.

From www.vecteezy.com

QBI letter logo design with polygon shape. QBI polygon and cube shape Real Estate Business Qbi So, their deduction is equal to 20% of domestic. roughly 97% of your clients have taxable income under the threshold. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. the irs released final guidance to help taxpayers figure out when. Real Estate Business Qbi.

From www.linkedin.com

Does Rental Real Estate Qualify for Section 199A QBI Deduction? Real Estate Business Qbi to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business or rental property, continue reading below. the irs released final guidance to help taxpayers figure out when rental real estate activities might qualify as a “trade or. the deduction allows eligible taxpayers to deduct up to 20. Real Estate Business Qbi.

From crazzyrewards.com

Real Estate Business for Beginners A Complete Guide Crewards Real Estate Business Qbi roughly 97% of your clients have taxable income under the threshold. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. So, their deduction is equal to 20% of domestic. to learn more about the qualified business income (qbi) deduction, and. Real Estate Business Qbi.

From www.youtube.com

QBI Deduction A GameChanger for Real Estate Investors! YouTube Real Estate Business Qbi roughly 97% of your clients have taxable income under the threshold. So, their deduction is equal to 20% of domestic. the irs released final guidance to help taxpayers figure out when rental real estate activities might qualify as a “trade or. to learn more about the qualified business income (qbi) deduction, and discover what it means for. Real Estate Business Qbi.

From makaansolutions.com

How to Start Real Estate Business in Dubai 2023 & Total Cost Real Estate Business Qbi So, their deduction is equal to 20% of domestic. to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business or rental property, continue reading below. 199a final regulations have been released to answer some of the lingering questions on whether rental real. the deduction allows eligible taxpayers to. Real Estate Business Qbi.

From www.dubaitravelbook.com

How to Start a Real Estate Business in Dubai Dubai Travel Book Real Estate Business Qbi the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. to learn more about the qualified business income (qbi) deduction, and discover what it means for your real estate business or rental property, continue reading below. 199a final regulations have been released. Real Estate Business Qbi.